1 + 1 = 2, or is it?

At TackWallet, we understand that a couple is made up of two individual people, each with their own perspective on and language of money.

And why not?

Each person will have lived majority of their lives, at least for a decade and change, independently. Certain behaviors and point of views would have already been adopted, and the mere thought of shedding these to compromise on a single perspective on personal finances is daunting. It is already hard for us to face our finances; what more the prospect of showing full transparency to our partners, which, to be perfectly honest, in my experience, feels as uncomfortable as being naked in a room full of strangers.

That is why navigating the complex landscape of shared finances can be one of the most challenging aspects of a relationship. There is always the idea of having to give up their usual comforts to accommodate the comforts of the other person. This idea of compromise, at least at the start, feels too foreign, too unjust; and trying to balance different spending habits and financial goals, amidst potentially very different earning capabilities, often leads to friction and misunderstandings. This is the reason why having a tool that facilitates clear communication of a north star, of a common result from joint effort and planning is essential as two people transition into being a couple.

Couple Goals, obviously

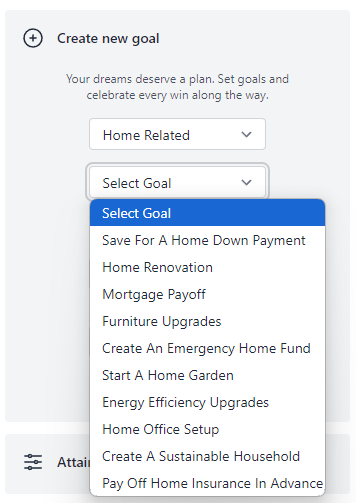

TackWallet provides a fun way of approaching joint goals for couples by offering a collaborative goal-setting feature called Couple Goals. Through the Couple Goals feature, partners can align their financial goals, celebrate milestones, and work together more effectively towards shared financial success. The key paradigm shift that TackWallet introduces with this feature is the concept of viewing the couple’s savings as a single well—a unified source for achieving both individual and shared goals.

This flexible methodology takes inspiration from zero-based budgeting, which sets clear expectations for where each dollar in a person’s, or in this case, couple’s, income will go.

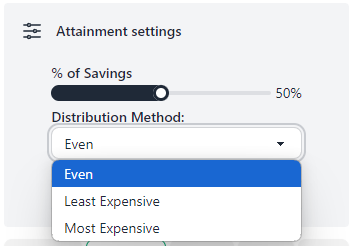

TackWallet’s Couple Goals feature offers three distinct ways to distribute a percentage of a couple’s savings:

- Even Distribution – Couples can opt to spread their savings equally across all their identified goals.

- Priority to the Most Expensive Goal – Savings are directed first towards the most costly goal, allowing couples to tackle their biggest financial hurdles early on.

- Priority to the Least Expensive Goal – Alternatively, couples can choose to focus on smaller goals first, achieving quick wins and building momentum.

This flexibility allows couples to visualize their financial path in a way that considers their unique preferences and needs, giving them a clearer understanding of how they can achieve their shared goals.

At TackWallet, we recognize that each individual brings their own financial habits and perspectives into a relationship, making the transition to joint financial planning both challenging and essential. By encouraging clear communication and offering a structured yet flexible approach to goal-setting and savings distribution, TackWallet helps couples navigate this transition smoothly.

Our approach allows couples to manage their finances together, transforming the daunting task of joint financial planning into a collaborative and rewarding experience.

Ready to take control of your shared financial future? Explore TackWallet today to see how our innovative features can help you and your partner achieve your goals together. Sign up now to finally start your financial journey as a couple!

Start your free TackWallet trial today!

Start gaining a clear understanding of your finances—together with your partner.

Start our trial